Transboundary Research

Former Project on Cybernetic Intelligence

Portfolio of Portfolios (P2O)

ゴールベース資産運用プラットフォーム

結婚、住宅購入、子どもの教育費など、人生において相応の支出を伴うライフイベントは複数あります。その到来時期、想定される必要資金、資金形成に対する必達度の三要素によりそれぞれのライフイベントに対応した目標を定義し、それぞれの目標ごとに特性の異なるバーチャルなポートフォリオを複数組成して資産形成および運用するためのプラットフォームである Portfolio of Portfolios (P2O) を、Sony CSLの佐々木貴宏研究員はソニーフィナンシャルホールディングス株式会社より Sony CSL 出向中の田尻貴夫氏と共同で開発しています。

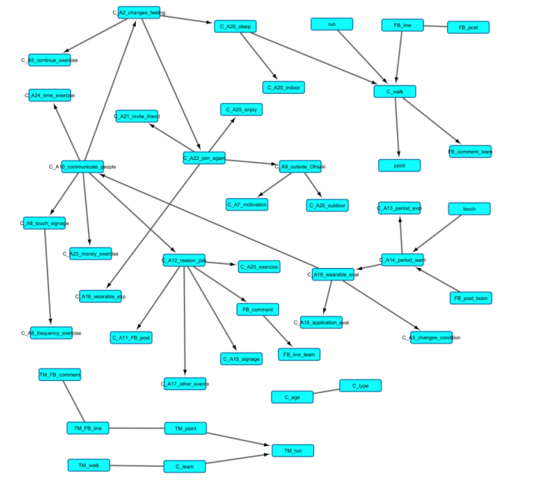

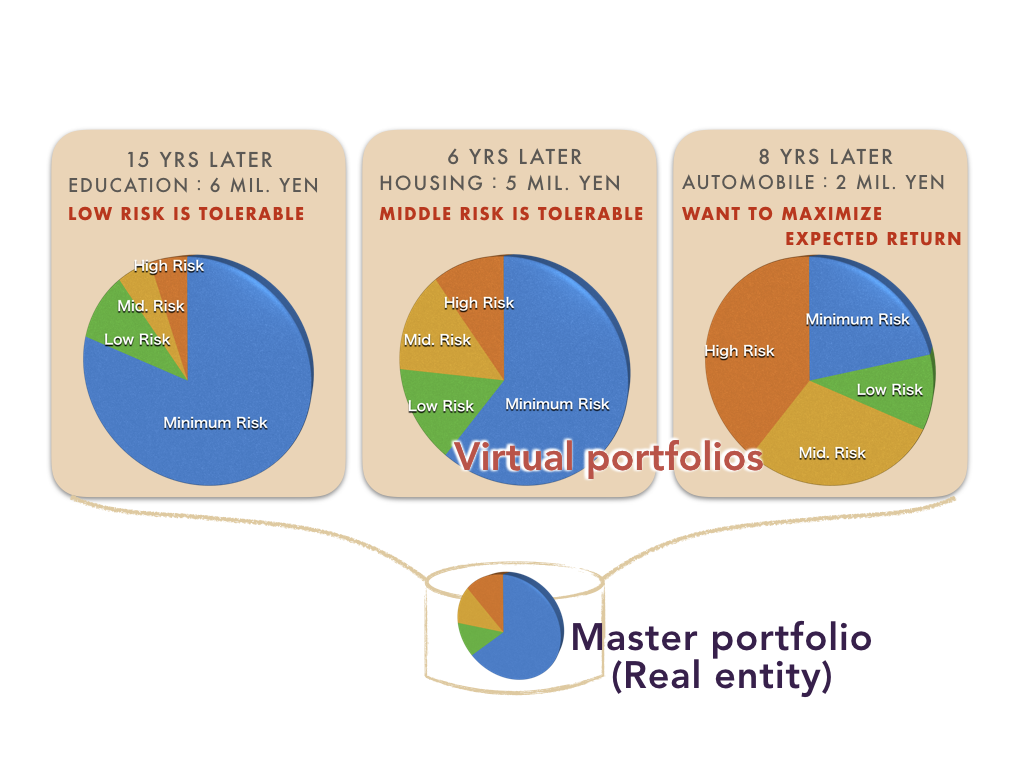

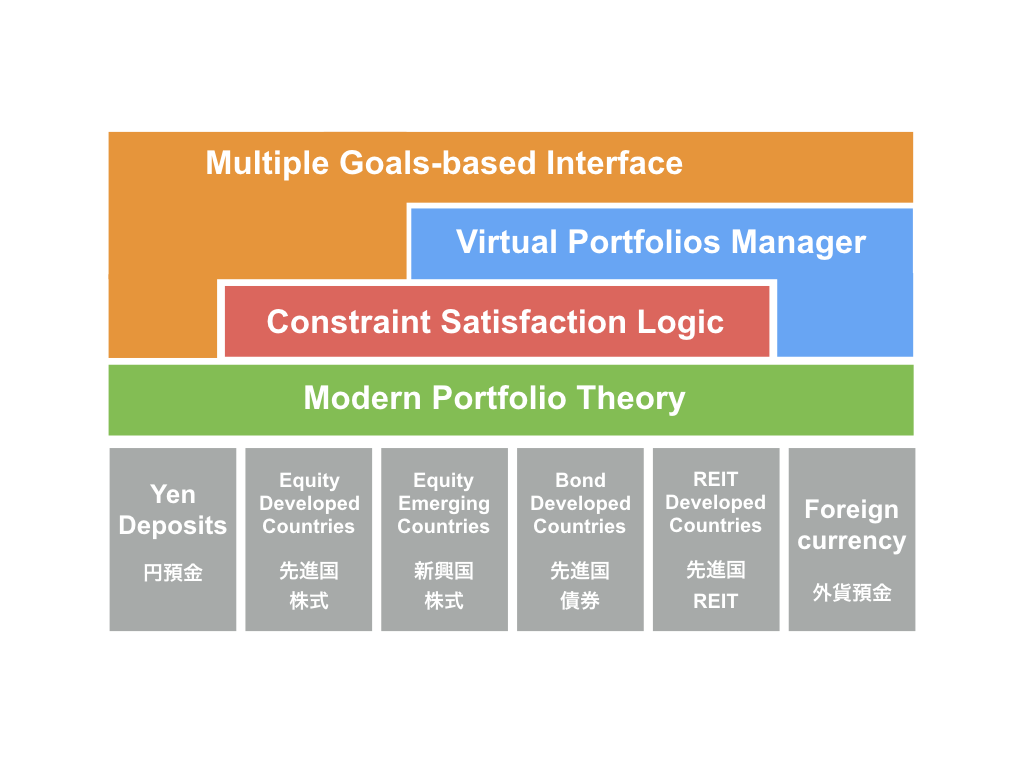

P2Oの核となる要素は二つあります。その一つは、設定された複数目標の全てを満たすような初期投入金や定期的な積立の計画や内訳の割り振りを決定する制約充足ロジックになります。一般的には利用者の保有資産や性格などによって「属人的」なものとして評価されることの多いリスク許容度という考え方ですが、P2Oのユニークな点はこれをそれぞれのライフイベントごとに異なるものとして紐づけた上で制約充足問題を解くところにあります。これにより、ライフイベントごとの重要度や優先度を反映した資産形成および運用を実現することが可能になります。

もう一つのP2Oの核は、目標ごとにバーチャルなポートフォリオを管理する部分です。これにより、目標金額に対する到達度合いが分かりやすくなるだけでなく、その到達度合いに応じて運用期間の途上で早期資産売却(現金化)や超過リターンを異なる目標間で振り分けることで、全ての目標の達成確度を向上させるといったことが可能になります。なお、ここで大元にあるマスターポートフォリオは単一であることがポイントです。バーチャルポートフォリオ間での資産の振り分けはマスターポートフォリオ内において可能な限り相殺される形で行われ、実際に発生する売買取引は最小化されます。なお、ポートフォリオの内容を見直すタイミングについては、事前に設定した期間ごとに機械的に行う以外にも、社会・経済状況の変化による市場環境の大規模な変化(Regime Switch)の検知や事前予測をトリガーに行うことも考えられます。

これらの二つの核に加えて、ライフイベントに対応する目標を設定するためのインタラクティブなユーザインタフェース層と、設定されたリスクに応じて運用資産の割り振りの最適化を行うモダンポートフォリオ理論とが組み合わさって、P2Oの全体が構成されます。P2Oプラットフォームの構成はレイヤー化されているため、様々なアセットクラスに柔軟に対応でき、それらの組み合わせにより、マス・リテール、プライベート・バンクや事業主向けサービスとして適用可能になっています。

[ 適用事例 – 「ほしいものナビBeta」 by ソニー銀行 ]

P2O の考え方を活用したものとして、2017年4月3日にソニー銀行より「ほしいのものナビBeta」のサービスがリリースされました。これは、複数のお金を貯める目標ごとに運用スタンス=お金のためかたを選択し、最終的にすべての目標を達成するための運用プランをロボットアドバイザーとともにインタラクティブに作っていくツールです。ちょっとした低額の買い物からリタイアメントといった高額のものまで、同時に最大5つまでの目標設定ができます。ポートフォリオの構成資産として投資性商品だけではなく円預金も含めることで、投資の初心者にも安心して利用できるようなものになっています。

Members

Related News

同じリサーチエリアの別プロジェクト

Cybernetic Intelligence

人とAIの協動によるストレスフリーなカスタマーサービスの実現へ

大規模データ解析ツール

人間とAIロボットとの関係性を問いかける体験型インスタレーション